Top Guidelines Of What If Only One Spouse Is Filing Bankruptcy

Shared debts are just one element which will majorly effects the ability of an individual to file bankruptcy. If both you and your spouse share debts, it may be best for the two of you to file for bankruptcy jointly.

Chapter thirteen. It's much simpler to qualify for Chapter thirteen than for Chapter 7. Rather than erasing your debt, this sort of filing reorganizes your expending. You'll get to keep your property, even so the court docket will get a price range so that you can continue to exist, which is able to involve a monthly payment program on your debts.

The option of joint bankruptcy in New Jersey permits partners to control money problems efficiently and economically. Listed here’s why it'd be a advantageous route:

In case you're looking at filing for bankruptcy, you're not by yourself. Each year, many hundreds of 1000's of people file for bankruptcy on account of their overwhelming credit card debt.

The Group discharge safeguards the non-filing spouse’s Group property from collection when discharge is entered. This applies to joint debts While only one particular spouse submitted for bankruptcy and been given a discharge. Safeguarded Group residence contains wages, lender accounts, and various personalized home.

It’s probable to pay back debts secured by own assets in the strategy, as well, including having to pay off an automobile bank loan. All or possibly a part of your unsecured debts, like bank card financial debt, is going to be compensated by your Chapter 13 prepare. In the end prepare payments are created, the bankruptcy court docket will concern a discharge buy erasing any remaining dischargeable personal debt.

Our team contains financial debt authorities and engineers who treatment deeply about earning the financial method accessible to Anyone. We now have earth-class funders that come with the U.S. federal government, previous Google CEO Eric Schmidt, and leading foundations.

If you need to do file separately, it should be completed in very good faith. The bankruptcy courtroom will take a look at your circumstances, and when it establishes that filing on your own was not done in great faith, it might dismiss the case with out discharging your debts.

These further facts allow our attorneys to achieve a deeper idea of the particulars of your case

The specialized storage or obtain check these guys out is needed for the authentic goal of storing Tastes that are not requested via the subscriber or user.

At Burrow & Associates, among the list of concerns clients usually ask our bankruptcy crew pertains to married couples and filing for bankruptcy.

You may want to file bankruptcy devoid of your spouse if you just lately bought married and all your financial debt is individual, premarital personal debt that the spouse isn’t liable to pay for or you two have a prenuptial agreement in position along with your spouse is not really liable on any of your debts. Within a reference Local community house condition, secured and unsecured debts incurred through the wedding by a person spouse are regarded as community debts.

That varies. Some vendors don't demand everything for their services, presenting counseling together with other equipment to teach you ways to regarding your like this cash and the way to fork out down your debts.

You shouldn't deliver any sensitive or confidential details by way of This useful source web site. Any info sent through This website doesn't produce a lawyer-consumer romantic relationship and might not be taken care of as privileged or confidential. Details you offer on This website is try here subject to our privateness plan.

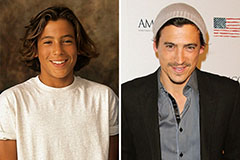

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Gia Lopez Then & Now!

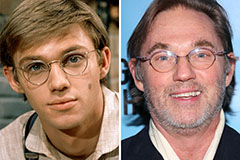

Gia Lopez Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!